You don’t need to be wealthy to invest, but you do need to invest to be wealthy

If you think you have to be wealthy to invest in property you might be mistaken! In fact the skills and experience you’ve gained managing a budget on a lower income could make you a better property investor than some big spending high income earners.

If you think you have to be wealthy to invest in property you might be mistaken! In fact the skills and experience you’ve gained managing a budget on a lower income could make you a better property investor than some big spending high income earners.

We often meet people who are hooked on the good life: living in expensive suburbs, driving fancy cars, frequently dining out and taking overseas holidays. Many will have built their wealth through a successful investment strategy but you may be surprised to find out how many don’t have adequate savings for retirement or redundancy, let alone a solid investment plan.

Lower income earners are often the ones who knuckle down and save. Careful budgeting, motivation and discipline are very important attributes of successful investors. If you have had plenty of practice stretching your dollar further and living within your means, you might already have what it takes!

Lower income earners can often have a more realistic view of investment risk.

They know they need to do something to get a better financial future. Many people are hesitant to invest because they just don’t like having debt. That’s a fair call… but you can reduce your risk.

Will you be part of the wealthier 20% OR will you be in the 80% of Australians who will need to rely on government support at retirement?

Why people do it

Around 20% of Australians invest in property for:

• potential capital growth

• rental income

• tax benefits

• long term wealth creation

They:

• tend to consider property one of the more solid, less volatile forms of investment because you can actually touch bricks and mortar

• like the feeling of getting ahead financially

• don’t want to be one of the 80% of Australians who have to rely on the aged pension when they retire

Why others DON’T

Around 80% of Australians don’t invest in property because they:

• don’t like debt

• need more information to take the first step

• don’t know how to ensure their investment property is not threatened by interest rate rises or unreliable tenants

• aren’t sure how to pick appealing properties for goodrental return

• don’t realise they can probably afford it – even if theydon’t have a big salary

• think all debt is ‘bad’ and haven’t realised aninvestment property could make them money and even pay for itself

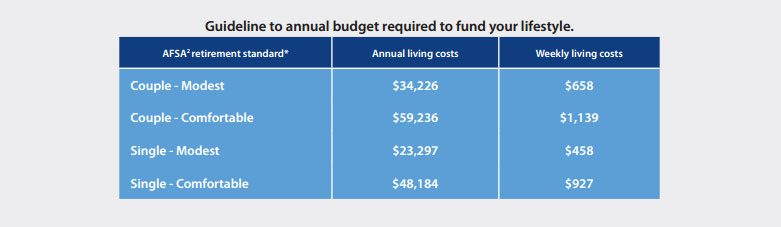

Did you know at the last census it was revealed 67% of men and 76% of women aged over 65 were living on less than $600 per week? Below is a guide to the income required for either a modest or comfortable lifestyle in retirement.

If you don’t act, nothing changes. Remember:

• You most likely have some good equity in your existing property

• Interest rates are at a current all time low

• Financial institutions off er a variety of investment loan products to suit various investor situations