Crushing credit card debt – Choosing the option that works for YOU!

The festive season is over but some of us may still have that warm glow from indulging our loved ones and perhaps even enjoyed a relaxing summer holiday. What wonderful memories…

So how is the credit card balance looking?

In Australia, over 70% of adults have at least one credit card. With nearly 17 million credit cards in circulation1 chances are this is also the time of year when some of us have to face the reality of our extravagance – in black and white on our credit card statement.

Options for credit card debt

What’s the best way to clear credit card debt? This will depend on your level of debt, the number of cards and your individual circumstances, however your choices might include:

• paying out the balance in full before interest accrues

• paying the maximum amount you can afford each month to clear the debt as quickly as possible

• (if you have more than one card) paying at least the monthly minimum on each card while allocating a larger payment to the card with the highest interest

• transferring your balance to a new credit card offering a lower interest period

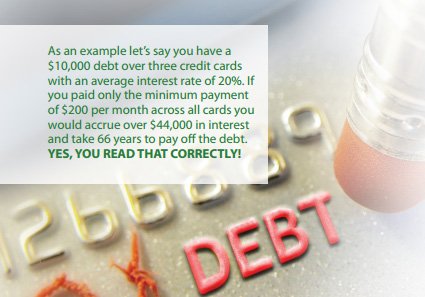

• consolidating your debt into your home loan At all costs you should avoid paying ONLY the minimum monthly repayment or you could be in a cycle of debt that is NEVER resolved.

At all costs you should avoid paying ONLY the minimum monthly repayment or you could be in a cycle of debt that is NEVER resolved.

Clearly, having a plan to repay credit card debt as quickly as possible is the best option…

Credit card balance transfers

Many lenders now offer credit card balance transfers with a range of rates and offer periods. You transfer the balance from your existing credit card to a new card at a lower (or even zero) interest rate for a set period to provide ‘interest breathing space’ to help you to pay off your debt quicker.

To ensure a credit card balance transfer works for YOU it is essential to know the terms and conditions of the card AND to be disciplined with repayments.

What should you know?

• To maximise the benefit you should pay ALL the transferred balance within the offer period.

• Know the offer end date! If possible set auto payments each pay that will clear the debt before that date.

• Any transfer balance at the offer end date will attract interest at the card’s standard interest rate.

• New purchases usually attract the standard interest rate – NOT the transfer interest rate.

• Know what fees apply and when they fall due, eg annual fee or percentage of transfer amount.

MOST importantly, cut up your old card(s) so you are not tempted to rack up even more debt while paying down the original debt!

A balance transfer should NOT be used habitually to manage recurring periods of debt! Poor financial habits and/or multiple credit enquiries may negatively impact your credit score – even if the enquiry didn’t proceed. This could influence your ability to be approved for a home loan in the future!

There IS another way…

Together we may consider consolidating all of your debt (credit card balances, personal loans, car loans etc) into one loan with a much lower average interest rate. If you are a home owner your home loan usually has the lowest interest rate.

Choosing YOUR best option should involve creating a budget, being brutally honest about your self-control when it comes to spending and repayments and then finding the fastest and lowest interest option to clear your debt. Need help? Give us a call TODAY